If you’re a California resident who drives a Tesla, you have the option of Tesla car insurance, which provides coverage specifically to Tesla Model 3, Model S, Model X, Model Y, and Roadster drivers at more affordable rates than other insurers. The company plans to expand its offering to other states in the future. Though Tesla may understand its own vehicles better than other insurance providers, this new insurance product may not meet every Tesla owner’s needs or come at the lowest rate.

If you’re considering purchasing a Tesla auto insurance policy, you should first shop around and compare insurance quotes from other car insurance companies.

You can even play with your coverage levels and deductible amounts until you get a price that fits your budget. Once you know what top auto insurance companies and local carriers alike can offer you, you’ll be able to make an informed decision about Tesla car insurance.

What is Tesla car insurance?

Tesla car insurance is designed specifically for Tesla drivers. The company takes into account the standard safety features available on all Tesla vehicles when determining policy pricing and does away with the fees charged by traditional insurance companies. The company also has unique knowledge of the repair costs associated with its vehicles. Tesla claims those factors can save drivers as much as 20–30 percent compared to the average cost of other car insurance providers.

Tesla Insurance provides bodily injury and property damage liability coverage, collision coverage, comprehensive coverage, and additional coverages designed for insuring electric vehicles. For example, Tesla offers a protection package for autonomous vehicle owners that can provide you with wall charger coverage, reimbursement for identity fraud expenses, and electronic key replacement. You can also get roadside assistance, gap insurance, rental reimbursement, and a total loss deductible waiver from Tesla.

In addition, Tesla provides insurance discounts based on your electric car’s autonomous driving functions. You also may be eligible for discounts common with other insurance programs, such as good driver discounts, anti-theft device discounts, loyalty discounts, and mature driver improvement course discounts.

State National Insurance handles the underwriting for Tesla Insurance Services. This insurance carrier has been in business since 1984 and has an A (excellent) financial strength rating with A.M. Best, indicating the company is likely to be reliable when paying claims. But unlike top insurers like State Farm and Allstate, State National Insurance Company isn’t rated by J.D. Power. The company also had double the number of complaints expected for a company of its size with the NAIC.

How does Tesla car insurance work?

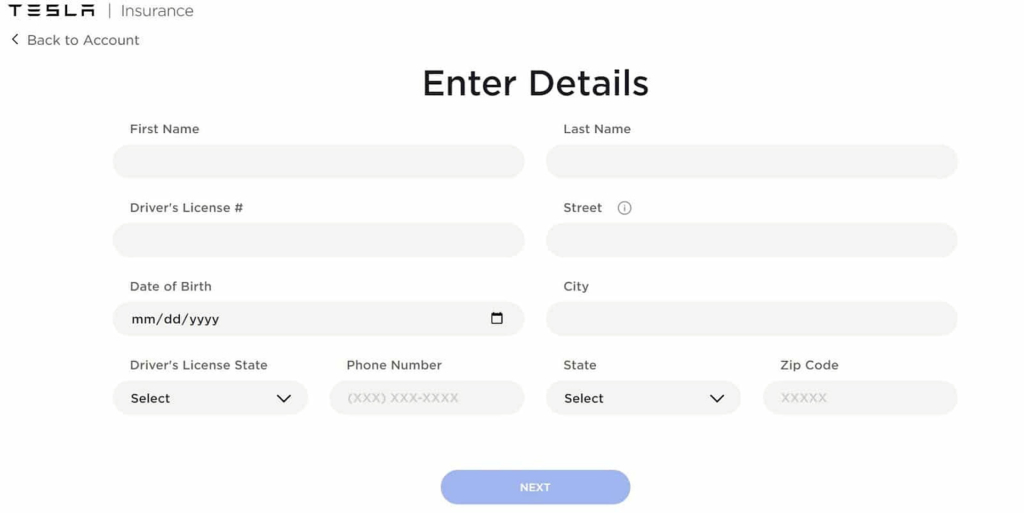

If you drive a Tesla in California, you can get insurance coverage from Tesla Insurance in as little as a minute. To get an idea of your Tesla insurance cost, start a quote on Tesla’s website. You’ll need to log in or create an account to get started, and then Tesla will immediately ask you for personal information, such as your driver’s license number and address. There are no anonymous quotes available, so have your information ready to see your car insurance rates.

Once you provide some additional information about your vehicle and driving history, you’ll be able to purchase a policy instantly online unless you need assistance with adding supplemental coverages. If you need help, you can contact 1 (844) 34-TESLA to speak to a licensed agent.

Tesla Car Insurance Reviews: Here’s what customers are saying…

Customer reviews about Tesla’s car insurance product are difficult to find. On third-party rating websites, customers mostly reviewed the company in general, citing poor customer service and the repairs process as reasons for their negative reviews. Tesla received the following ratings:

- ConsumerAffairs: 3.8/5 from 371 reviewers

- Trustpilot: 1.9/5 from 557 reviewers

- BBB: 1.49/5 from 194 reviewers

How to Save on Car Insurance

- Compare quotes: Every insurance provider will weigh your information differently, and the difference in premiums between two providers can amount to hundreds of dollars annually.

- Ask about discounts: When you use comparison, many discounts will be included in your customized quotes, but there are certain programs you may need to inquire about with your insurance agent. Once you’ve chosen an insurance company, review their available discounts, and ask about any savings you may be eligible for.

- Improve your credit: In most states, car insurance companies use your credit-based insurance score to determine your premium. Keeping up with your bills and paying down debt will improve your score, which will result in lower premiums.

- Maintain a clean driving record: Accidents, speeding tickets, and DUIs can significantly raise the cost of car insurance. Practice safe driving habits to avoid any infractions. You may even receive a discount if you stay accident-free for a period of time.

- Raise your deductible: Your deductible is the amount of financial responsibility you agree to take on in the event of a claim. A higher deductible means lower premiums, and vice versa. But remember that you’ll be on the hook for your deductible amount if you cause an accident, so be sure to keep enough cash in an emergency fund to cover it.

- Opt for liability coverage: While full-coverage car insurance is generally recommended, it can often double the cost of your insurance premiums. If you’re really struggling to afford your monthly premium, you may want to drop comprehensive and collision coverage. Just make sure you continue to maintain the required coverages for your state.

More about Tesla Car Insurance

Tesla has been in business since 2003 and was founded by a group of engineers that included Elon Musk, J. B. Straubel, Marc Tarpenning, and Martin Eberhard. The company builds electric cars and also provides clean-energy generation. In 2019, the company launched Tesla Insurance, which is currently only offered to Tesla drivers in the state of California. Tesla plans to expand to other states in the future.

You can get a quote, manage your policy, and pay your bills online with Tesla Insurance. You can also call a Tesla licensed agent if you need assistance, and there’s a general online form for questions as well.

| Website | www.tesla.com/support/insurance |

| Online Quote | www.tesla.com/insurance |

| Online Form | www.tesla.com/contact |

| Phone | 1 (844) 34-TESLA |

Tesla Car Insurance: Quick Questions

Is Tesla’s car insurance legit and safe to use?

Yes. Though Tesla has only been providing car insurance since 2019, policies are underwritten by State National Insurance Company, which has been around for decades. State National Insurance Company has an A (excellent) financial strength rating from A.M. Best, so you can count on the insurer to pay claims. However, the provider does have an above-average number of complaints with the NAIC, and there are concerning customer service reviews about Tesla in general.

How much does Tesla car insurance cost?

To find out your annual premium for Tesla car insurance, you’ll need to get a quote. Tesla claims to save drivers up to 20 percent or sometimes even 30 percent compared to traditional insurers. The company reports that it’s able to provide these savings through its understanding of its vehicles and reduced fees. While it’s possible a Tesla insurance policy could save you money, you should always compare quotes from other carriers before signing up.