While it can be easy to qualify for short-term loans—even if you have a low credit score or limited income—many come with unfavorable rates and terms. The high fees and interest rates make them an expensive form of debt, and the short repayment terms can leave borrowers financially worse off. In most cases, there are better, more affordable options. But knowing what a short-term loan is and how they work can help you make your most informed decision.

What Is a Short-Term Loan?

Short-term loans are loans issued with little or no collateral that must be repaid in a year or less, sometimes in only a few weeks. Because the credit requirements are lower, short-term loans charge a higher interest rate and generally come with fees and penalties.

Typically, installment loans stretch fixed payments out over several years, and borrowers have the option to repay early (sometimes for a fee). The long repayment period means you’ll pay less money each month, which can be beneficial in creating and sticking to a monthly budget. But short-term loans may have to be paid back within a few weeks or months, which makes the payments significantly higher and more difficult to manage. As a result, borrowers can wind up in a debt trap and need to take out a new loan to repay the first one. The higher interest rates and fees can also exacerbate the problem.

4 Common Types of Short Term Loans

In general, loans that have a repayment term of a year or less are considered short-term loans. Several types of loans often meet the criteria, including:

1. Payday loans

Payday loans are one of the most well-known types of short-term loans. They also go by cash advance, check advance, deferred deposit, or deferred presentation loans, but they all work in a similar way.

Borrowers generally receive the loan amount (which state laws may limit to $500 or less), minus fees. In exchange, you give the lender a post-dated check for the full amount or permission to take a direct debit from your bank account on a predetermined date. Most of these loans are repaid with a single payment within two to four weeks and can carry an annual percentage rate (APR) of nearly 400%. While many payday loans let you extend or “re-up” the loan, you’ll pay a fee and continue compounding interest. This puts many borrowers into a “debt trap,” continually renewing their payday loans to cover the interest and fees.

2. Auto title loans

Auto title or car title loans may be another option for a short-term loan if you have bad credit. You may be able to receive up to half the value of your vehicle as a loan, but the vehicle also acts as collateral. That means if you don’t repay on time or opt to rollover the loan, the lender can take the vehicle. In most cases, payment is due in 15 or 30 days, and the fees and interest result in an APR of over 300%.

3. Pawn loans

Pawnshop loans are another type of short-term secured loan. Similar to an auto title loan, you’ll hand over a personal possession in exchange for a loan based on the item’s value. You may have to repay the loan or pay a fee to renew your loan within 30 to 180 days in order to reclaim your property. Otherwise, the pawnshop can take and sell your item. In addition to interest, you may have to pay fees to set up the loan and store your items, which can lead to triple-digit APRs.

4. Short-term personal loans

Some lenders offer short-term personal loans with quick repayment schedules and high interest rates. Rather than requiring a single payment, like a payday, auto, or pawn loan, you’ll make weekly, biweekly, or monthly payments on a predetermined schedule.

If the loan has a repayment period of six-months or less, most states limit the APR that lenders are allowed to charge to less than 50%. But that’s still high compared to other lending options. And, some online lenders partner with banks in different states to offer loans with interest rates above the borrower’s state limits.

These high-rate, short-term personal loans shouldn’t be confused with other types of personal loans. Many unsecured personal loans have longer repayment terms and lower interest rates, which can give borrowers access to a large loan with reasonable monthly payments.

Reasons Why People Get Short-Term Loans

Most short-term loans are a last resort for borrowers who might not qualify for other types of loans, and there are times when getting an expensive loan is better than nothing.

Lack of credit

Some people turn to high-rate, short-term loans when they need immediate funds but don’t have the credit or income to qualify for a better loan or line of credit elsewhere.

To pay household bills

Often, short-term loans are taken out to help cover immediate needs, like rent, utilities, food, and transportation. If you’re struggling with household bills, reach out to your landlord, creditors, and utility providers to see if you qualify for assistance.

To cover major expenses

Some lenders offer short-term loans for thousands of dollars, which could make them an option if you need money fast for a major emergency or large expense. However, a longer-term personal loan is likely a better option, as the lower monthly payments could be easier to manage.

The Pros and Cons of Short-Term Loans

Short-term loans can be beneficial when you’re in a financial pinch, but proceed with caution. Here are some of the major pros and cons.

Pros

- You don’t need good credit: Many short-term loans don’t require good—or any—credit to get approved.

- You may have access to funds faster: The lack of a credit check can increase the approval and funding process, which means you may be able to get the loan the same day you apply.

Cons

- They’re expensive: Lenders often charge high fees and interest rates, which can make short-term loans an extremely expensive type of debt. They’re often even more expensive than credit cards.

- They can be difficult to repay: Because they must be repaid quickly, many borrowers are unable to come up with enough money to repay the short-term loans plus added interest and their ongoing household bills. As a result, they might need to take out another loan or pay a fee to extend the first loan and wind up trapped in a debt cycle.

- They may require collateral: Some short-term loans, such as auto title and pawn loans, require you to use your personal property as collateral. As a result, you may lose your property if you’re unable to pay the loan on time.

Reasons to Consider Using a Personal Loan Over a Short-Term Loan

Generally speaking, personal loans offer lower interest rates than short-term loans. Additionally, the longer term means you’ll have a lower monthly payment, which can make managing your monthly cash flow easier and less stressful. Even if you have to pay an origination fee, a personal loan is likely a better option than a short-term loan.

Personal loans versus short-term loans

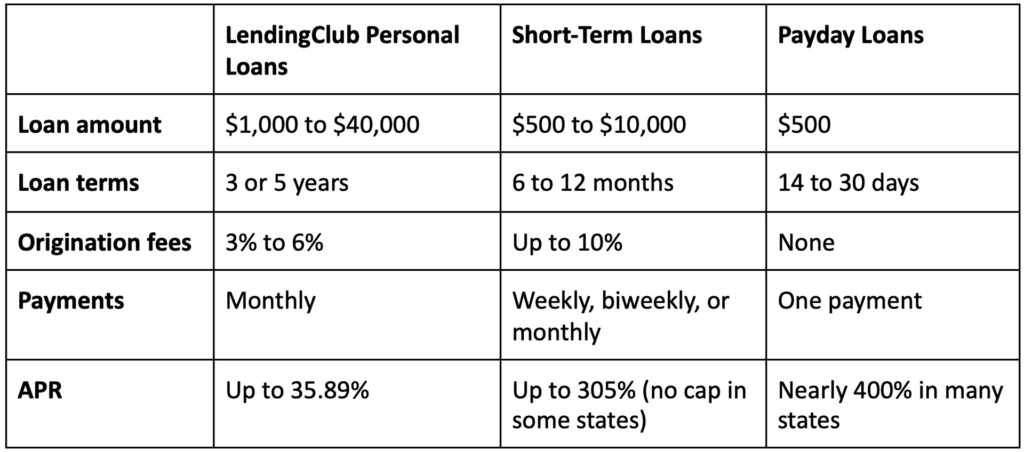

Loan options, rates, and terms can vary depending on the lender and state regulations, but here’s a side-by-side comparison of common loan terms.

Short-Term Loans FAQs

1. What’s the average time frame for a short-term loan?

Loan repayment terms vary depending on the type of short-term loan and your state’s regulations. Many loans must be repaid within 14, 30, or 60 days, though some lenders offer terms of six months to a year.

2. How high are interest rates for short-term loans?

Comparing loans’ APRs can be more helpful than interest rates, as the APR accounts for the repayment period, interest rate, and lender’s fees. In some states, a $300 payday loan with a 14-day term could have an APR over 500%. In contrast, many personal loans have an APR of 36% or lower.

3. Can you get a short-term loan with bad credit?

Generally speaking, you can get a short-term loan even if you have bad credit. In fact, a low credit score may be one reason borrowers don’t qualify for longer terms and less expensive loans. If you can, boost your credit score before applying for a loan to qualify for more favorable terms.

4. When should I choose a personal loan over a short-term loan?

A personal loan with a longer term may be a better option if you need to borrow more than a few hundred dollars and have the creditworthiness needed to qualify for a low interest rate. Longer terms lead to lower monthly fees, which can make it easier to repay the loan without impacting your other household expenses.

5. Are cash advances short-term loans?

Credit card cash advances aren’t technically short-term loans because you don’t have a specific repayment term for the money you borrow. But similar to a payday loan, where funds are advanced against your paycheck, cash advances offer immediate cash against your line of credit—like buying cash with your credit card. But take the time to read the terms of a cash advance before taking one out, as there might be more affordable options. For example, most credit card companies charge cash advance fees, and the interest rate may be higher than normal charges, making a cash advance an expensive option.